- The Analytics Ladder

- Posts

- Stop talking accuracy. Start talking bets.

Stop talking accuracy. Start talking bets.

The midweek playbook for turning book smarts into career-making influence.

Why this issue matters:

Your value isn’t in the model. It’s in whether leaders act on it.

Keep talking decimals and you stay invisible. Translate odds, upside, and downside, and you become indispensable.

This issue gives you the script to close that gap, so your work drives decisions, and your career moves with them.

This newsletter is free. Hosting it isn’t.

Clicking this link is how you tip the writer, keep the ladder strong, and help more analysts break through.

It takes 10 seconds - click the link, close down the window that opened, you feel awesome.

The back office, built for founders

We’ve worked with over 800 startups—from first-time founders at pre-seed to fast-moving teams raising Series A and beyond—and we’d love to help you navigate whatever’s next.

Here’s how we’re willing to help you:

Incorporating a new startup? We’ll take care of it—no legal fees, no delays.

Spending at scale? You’ll earn 3% cash back on every dollar spent with our cards.

Transferring $250K+? We’ll add $2,000 directly to your account.

The simple shift that makes executives see your value.

Your model isn’t 85% accurate. It’s a bet with 4-to-1 odds.

You built the model. You cleaned the data. You nailed the presentation. The ROC curve is a thing of beauty.

Then the CFO leans forward and asks, “So what does this mean for the P&L? Are we doing this or not?”

You pull up a chart. You mention confidence intervals. You talk about precision and recall. And you watch as the energy drains from the room.

Eyes glaze over.

The decision gets deferred.

..

If you want leaders to act, you have to change the language. Stop talking about the elegance of your model and start talking about the quality of the bet.

This insight comes from Annie Duke’s masterpiece, Thinking in Bets. And we apply it to the Data & Analytics landscape and how it can shift your career.

World-class poker players never have certainty. They can’t. What they have is a deep understanding of the odds, the potential upside, the committed downside, and a disciplined process for deciding if the bet is worth taking.

That is the exact mindset you need to translate complex analytics into decisive executive action.

This playbook shows you how.

The Credibility Gap Costing You Influence

There is a fundamental disconnect in how analysts and executives see the world.

Analysts optimize for precision. We chase the extra point of accuracy, the cleaner signal, the more robust backtest. Our work is a quest for certainty.

Executives optimize for outcomes. They manage risk, allocate capital, and make decisions under pressure with incomplete information. Their work is a portfolio of bets.

When you say “85% accuracy,” you think you’re communicating rigor.

But what they hear is “15% chance of failure,” uncertainty, and a reason to delay. Your probabilistic nuance sounds like a lack of conviction.

Percentages do not move budgets. Clear-eyed bets do.

The Operator's Mindset

A good decision is not a guaranteed outcome. It is a bet with a positive expected value, made with incomplete information, and executed with discipline.

Your role is not to be a fortune teller. It is to be the house, setting the odds.

Your job is to lucidly state those odds, price the upside and downside in the language of the business, and make a clear recommendation: place the bet, wait for a better card, or fold.

This shift in framing is what elevates an analyst from a report-runner to a trusted operator.

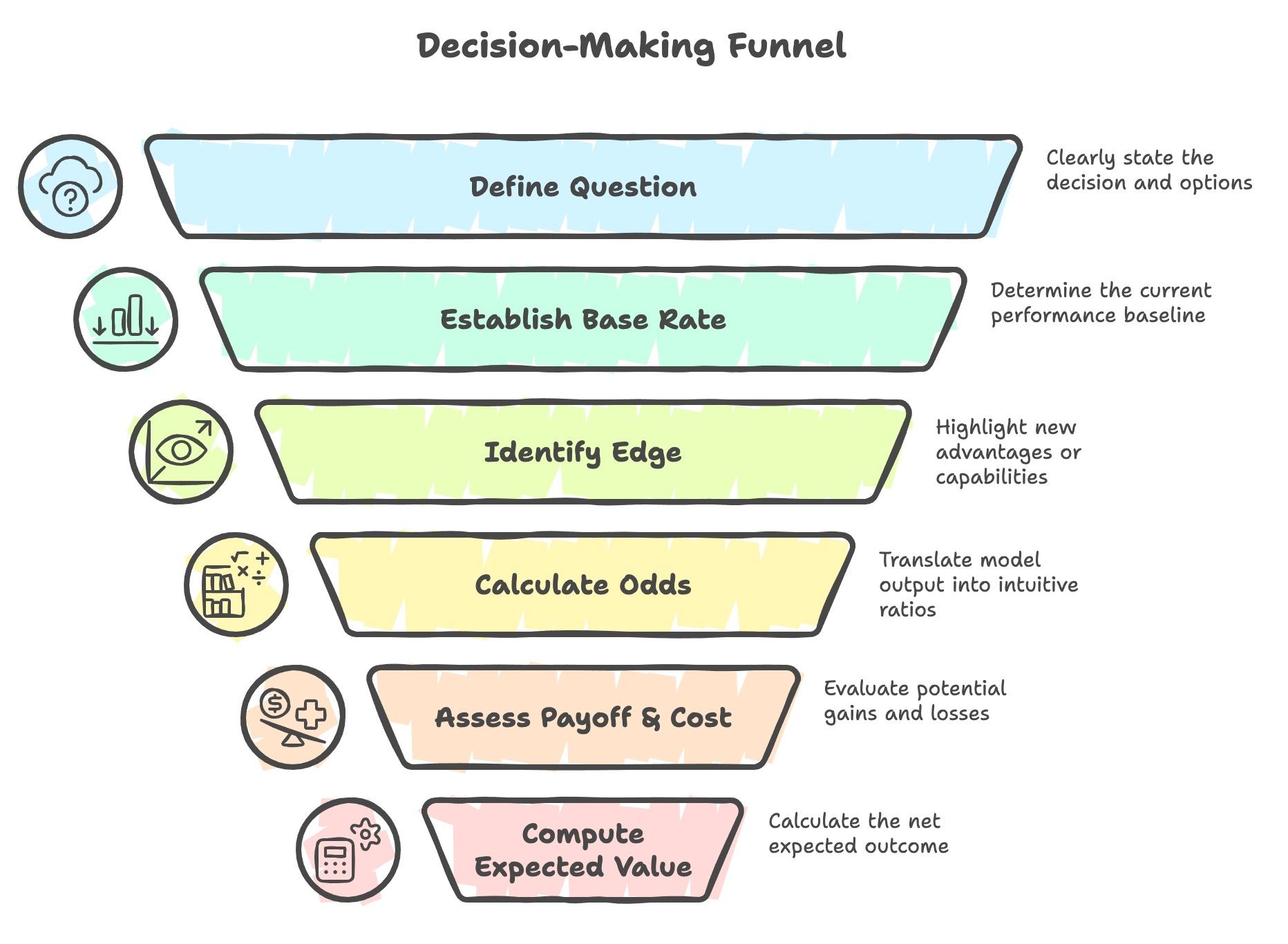

The 7-Step Bet Briefing

Use this disciplined structure for every recommendation you make. Keep it to a single slide or the top half of an email.

Make it tight, concrete, and impossible to ignore.

The Question: State the specific decision being made, the deadline, and the available options. Frame it clearly. Example: “Should we roll out the new retention offer to at-risk subscribers before Q3 begins?”

The Base Rate: What happens if we do nothing? What do typical results look like in this situation? Anchor the conversation in reality. Example: “Our historical quarterly churn rate for this segment is 12%.”

The Edge: Why is this time different? What new information or capability gives us an advantage over the base rate? This is where your model is the hero. Example: “Our new model identifies true at-risk accounts with 3x greater precision than our old rules-based system, confirmed in two back-tests.”

The Odds: Translate your model's output into a simple, intuitive ratio. No decimals. Example: “This means for every 5 accounts we target with this offer, we expect to prevent churn for 4 of them. The odds are approximately 4-to-1 in our favour.”

The Payoff & The Cost: What is the upside if we win, and what is the downside if we lose? Price it in dollars or the single KPI the business cares about most. Example: “The upside is saving $2M in gross margin over two quarters. The downside is the $500k cost of the incentives if they fail to move the needle.”

The Expected Value (EV): Show the math. Make your logic transparent. The formula is simple: EV=(Pwin×Payoff)−(Ploss×Cost). Example: “The expected value is (0.8×$2M)−(0.2×$500k)=$1.6M−$100k=+$1.5M.”

The Move: Make the call. Bet now, wait for more information, or avoid the bet entirely. If you recommend action, propose the smallest, safest version of the bet that can validate your edge. Example: “The EV is strongly positive. I recommend we place a controlled bet now.”

The Script You Can Lift

Here is how this sounds in a meeting. Use this adjusted to your situation.

Our model gives us an edge, not certainty. The best way to think about this decision is as a bet.

The Odds: We’re looking at roughly 4-to-1 odds in our favour.

The Upside: If we win, we stand to save $2 million in churn over the next two quarters.

The Downside: If we lose, we’ve spent $500 thousand on incentives with minimal lift.

The expected value of this bet is a positive $1.5 million.

I recommend we place a controlled bet. Let’s start with just the top two at-risk segments, run the program for six weeks, and review the value ledger at the three- and six-week marks to decide if we scale or kill it.

This is a business proposal. It’s concrete, defensible, and gives leaders exactly what they need to approve it in the room.

The Value Ledger: Your Political Capital Engine

Track every recommendation you make like a portfolio manager. You are not just running analyses; you are building a track record. This ledger is the documented proof that your team generates alpha for the business, turning anecdotes into undeniable credibility.

Use these columns:

Decision Name: A clear, concise label for the bet.

Date Placed: When the decision was made.

Odds Stated at Decision Time: Why it matters: This is your defense against hindsight bias. It proves you made a sound judgment with the available information, regardless of the outcome.

Stake Deployed: The resources (cost, time, people) committed to the bet.

Expected Value at Entry: The calculated EV from your briefing.

Safeguards in Place: Any stop-losses, kill switches, or review triggers.

Result at Checkpoint One: The initial outcome against your hypothesis.

Final Result & Realised Value: Why it matters: This is the number that goes into your performance review and your team's budget justification. It translates your work directly into the language of the CFO.

Lessons: What did you learn about your model, the market, or your operations?

If you do nothing else, track Odds Stated and Realised Value.

Over a single quarter, you will have a powerful story to tell about how your team places winning bets.

Phrases That Land

Scrub "accuracy" from your vocabulary. Replace it with language leaders act on.

When Presenting the Bet: "Here is the bet, here are the odds, here is the stake."

When Discussing Risk: "We have a stop-loss at the three-week mark and a kill switch if X happens."

When Reviewing Results: "This was a positive EV bet that didn't pay off. Here's what we learned, and here's how it makes our next bet better."

The Core Principle: "The upside and downside are priced in dollars, not decimals."

Strategic Traps to Avoid

Hiding behind confidence intervals. Instead: Make a call, then bound the risk. State your recommendation clearly, then use the stop-loss and controlled rollout to define the blast radius if you're wrong.

Ignoring the base rate. Instead: Anchor in reality, then prove your edge. Always start with what usually happens, then show precisely how your insight changes the odds.

Presenting five KPIs. Instead: Focus on the one metric that matters. Identify the single most important variable for the decision and frame the entire bet around it.

Asking for a full rollout. Instead: Propose the smallest bet to prove the point. De-risk the decision for leaders by designing a small, fast, and cheap test.

Curated Intelligence

Some additional reading to round out this strategy

Annie Duke on Probabilistic Thinking

Takeaway: The goal isn't to be right every time. It's to be profitable over time. Better decisions come from sizing your bets correctly, not from chasing an illusion of certainty.

Why Data-Driven Decisions Still Fail

Takeaway: Models are useless without context. Ignoring base rates and the operational realities on the ground is how brilliant analytics lead to costly failures.

Link: https://hbr.org/2019/05/why-data-driven-decisions-fail

Expected Value in Plain English

Takeaway: EV is the simple, powerful antidote to hand-wavy, gut-feel decisions. It forces a disciplined conversation about probability and payoffs, which is the foundation of any sound business case.

Promo time!

Struggling to get leaders to notice the value you create? Grab my new Visibility Kit - 7 Moves Analysts Use to Get Noticed by Leadership.

It shows you how to narrate your work in leadership’s language, capture wins in a ledger, and avoid the “report shop” trap.

Your models are not fortune tellers.

They are odds calculators.

When you learn to translate their output into the language of bets, leaders stop debating decimals and start making moves. That shift is how analysts become indispensable.

If you use the 7-Step Bet Briefing this week, reply and tell me how it landed. I read every single note.

Best,

Tom.

P.S. The best way to prove this works? Place a bet. I'm betting this framework will resonate. I'll be tracking its value ledger and I hope you'll start tracking yours.

Know one teammate who’s drowning in rework or worried AI is eating their job? Forward this to them, you’ll help them climb and unlock the new referral reward: the Delta Teams Playbook, your crisis-mode toolkit when the wheels come off.

Not on The Analytics Ladder yet? You’re missing the brand-new 90-Day Analytics Leadership Action Kit. It’s free the moment you join: your step-by-step playbook to win trust in 14 days, build a system by day 45, and prove dollar impact by day 90.

Disclaimer: Some of the articles and excerpts referenced in this issue may be copyrighted material. They are included here strictly for review, commentary and educational purposes. We believe this constitutes fair use (or “fair dealing” in some jurisdictions) under applicable copyright laws. If you wish to use any copyrighted material from this newsletter for purposes beyond your personal use, please obtain permission from the copyright owner.

The information in this newsletter is provided for general educational purposes only. It does not constitute professional, financial, or legal advice. You use this material entirely at your own risk. No guarantees, warranties, or representations are made about accuracy, completeness, or fitness for purpose. Always observe all laws, statutory obligations, and regulatory requirements in your jurisdiction. Neither the author nor EchelonIQ Pty Ltd accepts any liability for loss, damage, or consequences arising from reliance on this content.

Visit our website to see who we are, what we do. | |

Our blog covering the big issues in deploying analytics at scale in enterprises. |